AI 13F Smart Money Watch

ai13F.com is an AI-powered SEC 13F filings analytic tool for retail investors. It helps discovering hidden market signals and leveraging them as content of this smart money watch web service.

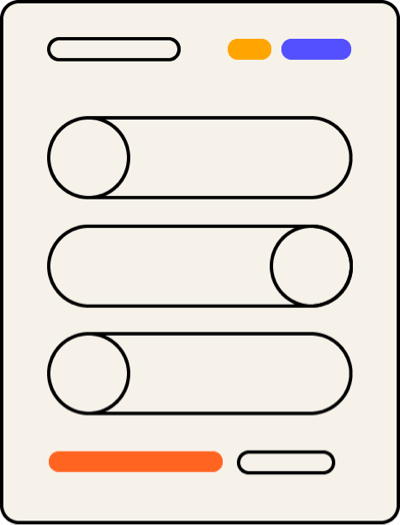

Tangibly it provides intuitive portfolio tracking, comparison, and analysis of institutional strategies.

What is SEC 13F:

SEC 13F is a quarterly report required by the US Securities and Exchange Commission (SEC) for institutional investment entities which manage at least $100 million in assets.

The goal is to increase transparency of large institutional investors, thereby boosting investor confidence in the market.

Discover Hidden Market Signals from 13F Filings

Currently there are two types of AI insight report you can generate:

1. Compare two quarters of an investment entity

2. Compare two investment entities on one quarter

Disclaimer:

SEC Form 13F filings reflect holdings as of a prior period and are subject to a 45‑day reporting lag. ai13f.com does not provide investment or trading advice; it is only a reference tool intended to inspire trend and cluster analysis for broader investment research.

Key Features

AI-driven SEC 13F Comparative Analysis

Our AI agent leverages expertly crafted professional prompts from your simple form entries to systematically analyze SEC 13F filings with high accuracy and efficiency.

This streamlined process enables precise comparison of institutional portfolios, uncovering valuable investment patterns that support informed and strategic asset management decisions.

AI Tool to Discover Hidden Market Trends

AI excels at identifying complex patterns within large datasets of SEC 13F filings, uncovering valuable insights that are often overlooked by traditional analysis methods.

By providing early detection of emerging opportunities and risks, AI supports proactive market engagement, effective risk management, and timely investment decisions, leading to improved financial outcomes.

Actionable AI Insights from SEC 13F Filings

Our structured content feeds ensure AI efficiently processes and interprets complex regulatory data. This foundation transforms raw information into clear, actionable insights for asset managers.

By delivering data-driven recommendations, the AI empowers asset managers to optimize holdings, anticipate market movements, and enhance portfolio performance with greater confidence and precision.

Read Them for Free

Sign Up for Free Newsletter

The SEC 13F compliance monitors over 8,000 investment entities in the US and abroad.

Enter your email below to receive weekly notifications when new free-to-read insight reports are published by our registered members.

AI Research on 8,000+ Institutional Funds

Unlock powerful AI insight tool we built on SEC 13F filings — join today and elevate your investment research like a pro~

Sitemap

Why 13F Filings

Understanding the rationale behind their buys and sells can offer us individual investors a window into high-conviction themes and strategic positioning. Despite them being delayed, it provides some insight into what the best money managers are doing.